Reclaim Your Time

Lead With Clarity

Scale With Confidence

Develop a Thrilling Vision

Strategic guidance and financial insight for business owners ready to stop reacting and start transforming.

You’ve built the revenue. Now let’s build the business that runs without you.

Our proven frameworks help YOU, a high-achieving owner, remove bottlenecks, delegate smarter, and finally enjoy the business you’ve worked so hard to create.

[ Get Your Free Business Clarity Guide ]

🧩 “Breaking Free from Business Overwhelm: 3 Immediate Actions to Regain Clarity & Control”

About Business Transformation Advisor

Mission Statement

Our team of experienced business development professionals is dedicated to providing the best possible service to our clients.

We have a wide range of skills and expertise, and we work together to provide comprehensive solutions to our clients' business needs.

We believe in taking a collaborative approach to business development.

We work closely with our clients to understand their needs and develop customized solutions that meet their unique challenges.

Our Vision

We approach business challenges through a combination of collaboration, strategic planning, forecasting, implementation, measuring, and adapting. You can "next-level" your business by following our process; and we will walk with you thru out the process.

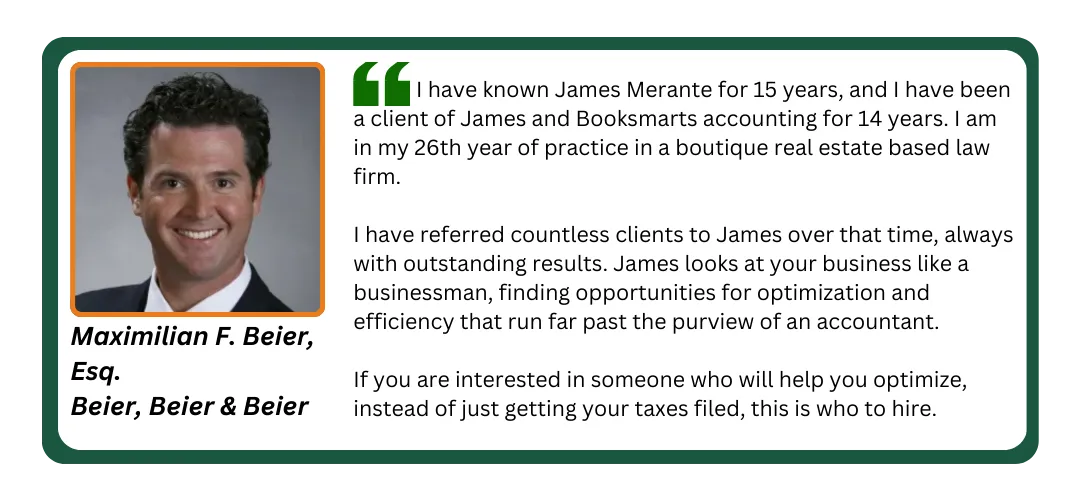

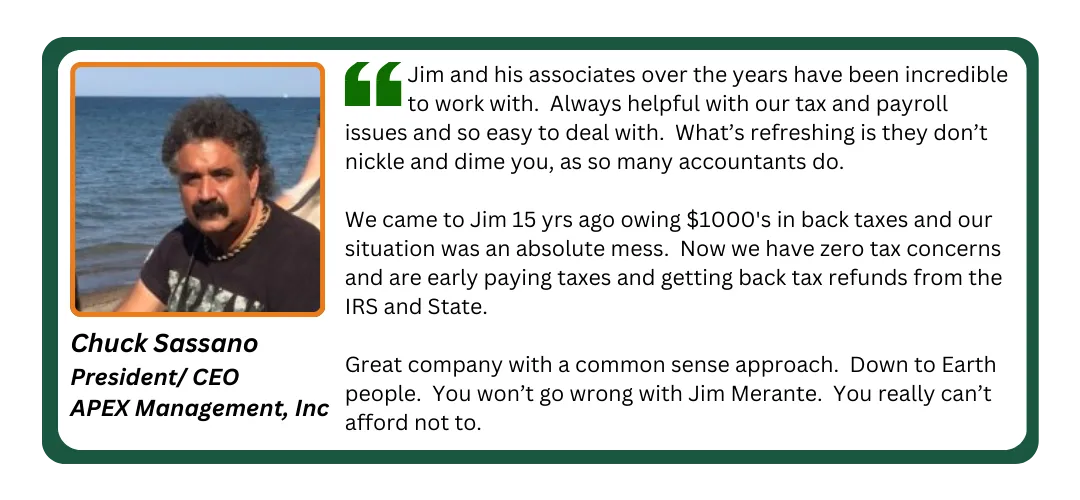

What Customers Are Saying

FAQs

My Company's books are a nightmare! I don't even know where to start!

We take care of your books for you, so you can get back to the job of running your business and generating profits.

I'm spending all my time managing payroll for my employees.

We offer payroll solutions that meet your business's needs and enable you to spend time doing what you do best--running your company.

I use Quickbooks but I'm not sure I'm getting the most out of the software.

We offer a variety of services to help make sure that you are taking full advantage of Quickbooks' many features.

Should I keep a cash reserve in my small business?

You should always keep enough cash on hand to cover expenses and as an added cushion for security. Excess cash should be invested in an accessible, interest-bearing, low-risk account, such as a savings account, short-term certificate of deposit or Treasury bill.

I need help planning my family's financial future.

We offer one-on-one guidance and a comprehensive financial plan that helps manage risk, improve performance, and ensure the growth and longevity of your wealth.

Latest News

Upcoming Tax Due Dates

Stay on top of important IRS tax deadlines for May and June. From Form 990 filings to employer deposit requirements and tip reporting, here’s what business owners and nonprofits need to know now. ...more

May 2025

May 28, 2025•0 min read

Facilitate IRS Transactions With a Business Tax Account

Streamline your IRS interactions with a Business Tax Account. Learn how this secure portal helps manage payments, view records, and simplify transactions for your company. ...more

May 2025

May 28, 2025•1 min read

Tax-Advantaged Savings Accounts That Benefit Those With Disabilities

Eligible individuals with disabilities can use ABLE accounts to save for key expenses—tax-free—without affecting government benefits. Learn the 2025 limits and how to make the most of this powerful fi... ...more

May 2025

May 28, 2025•1 min read

Helping a Family Member Buy a Home

Looking to help a family member buy a home? Learn the smart ways to provide financial support—whether through gifts or loans—while staying within 2025 tax limits and avoiding costly consequences. ...more

May 2025

May 28, 2025•1 min read

The High Cost of Worker Misclassification: Tax Implications and Risks

Misclassifying workers as independent contractors can lead to serious tax penalties and legal risks. Learn how to avoid costly mistakes and properly determine worker status in today’s complex employme... ...more

May 2025

May 28, 2025•3 min read

Traveling With Your Spouse on Business? Know What's Deductible

Wondering if you can deduct your spouse’s travel expenses on a business trip? This post breaks down what’s actually deductible, when your spouse qualifies as a business expense, and how to avoid commo... ...more

May 2025

May 28, 2025•3 min read

We will answer all of your questions, as they impact both your tax and financial situations.

We welcome you to contact us anytime.

At Business Transformation Advisor, we've been helping, consulting, and advising businesses of all kinds to thrive, scale, and free their owners from just having a self-employment job for years.

If you need help improving any aspect of your business, we want to hear from you.

Please fill out this form and let us know how we can be of service.

Thank you for visiting. We look forward to working together!

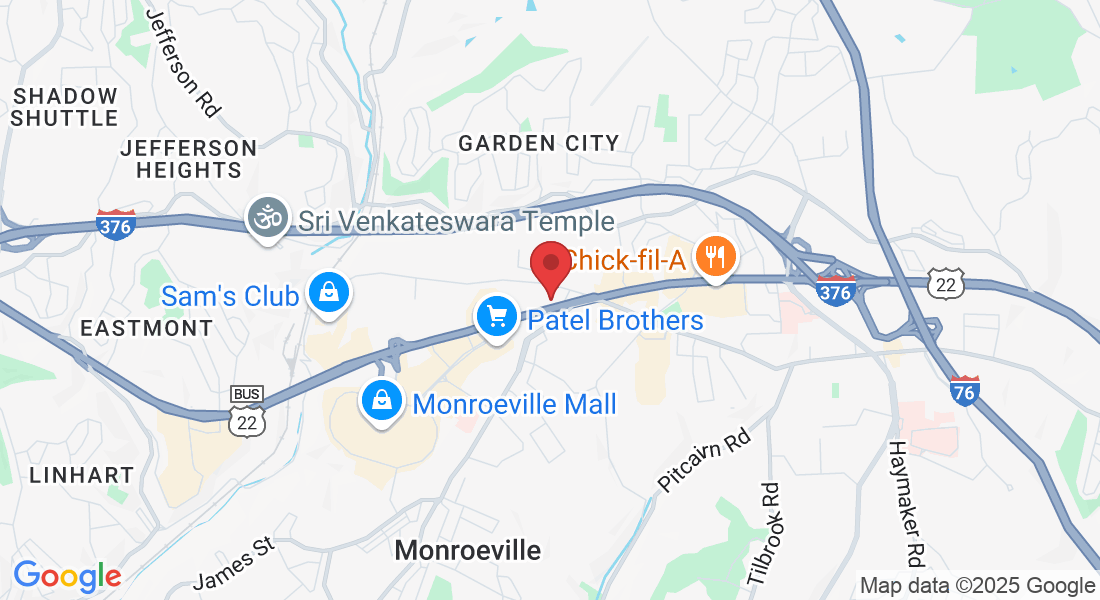

Contact Info

Business Transformation Advisor

Phone: 412-881-0892

3824 Northern Pike, Ste 815

Monroeville, Pennsylvania, 15146

Client Portal

Enter for training opportunities and our free community for Business Leaders

Contact Us

Business Transformation Advisor

c/o Management Horizons, Inc

3824 Northern Pike, Ste 815 Monroeville, Pennsylvania 15146

Newsletter

Subscribe to our newsletter to receive news, updates, and valuable tips.