Frequently Asked Questions

Top Q&A

My Company's books are a nightmare! I don't even know where to start!

We take care of your books for you, so you can get back to the job of running your business and generating profits.

I'm spending all my time managing payroll for my employees.

We offer payroll solutions that meet your business's needs and enable you to spend time doing what you do best--running your company.

I use Quickbooks but I'm not sure I'm getting the most out of the software.

We offer a variety of services to help make sure that you are taking full advantage of Quickbooks' many features.

Should I keep a cash reserve in my small business?

You should always keep enough cash on hand to cover expenses and as an added cushion for security. Excess cash should be invested in an accessible, interest-bearing, low-risk account, such as a savings account, short-term certificate of deposit or Treasury bill.

I need help planning my family's financial future.

We offer one-on-one guidance and a comprehensive financial plan that helps manage risk, improve performance, and ensure the growth and longevity of your wealth.

Table of Contents

Over 500 every day financial questions answered.

Business Owners

Small Business

How can I ensure that my small business will survive the transition into the next generation?

Less than one-third of family businesses survive the transition from first to second generation ownership. Of those that do, about half do not survive the transition from second to third generation ownership. At any given time, 40 percent of U.S. businesses are facing the transfer of ownership issue. Founders are trying to decide what to do with their businesses; however, the options are few.

The following is a list of options to consider:

Close the doors.

Sell to an outsider or employee.

Retain ownership but hire outside management.

Retain family ownership and management control.

There are four basic reasons why family firms fail to transfer the business successfully:

Lack of viability of the business.

Lack of planning.

Little desire on the owner's part to transfer the firm.

Reluctance of offspring to join the firm.

The primary cause for failure is the lack of planning. With the right succession plans in place, the business, in most cases, will remain healthy.

What's involved in succession planning for family businesses?

Transferring the family business requires the family to make a determined effort to do the following:

Create a business strategic plan.

Create a family strategic plan.

Prepare an Estate Plan.

Prepare a Succession Plan, including arranging for successor training and setting a retirement date.

These are the four plans that make up the transition process. By implementing them, you will virtually ensure the successful transfer of your business within the family hierarchy.

Q: What is a business strategic plan?

A: A business strategic plan defines goals, objectives, and targets for a company and outlines its resources will be allocated in order to achieve them. When a strategic business plan is in place, it allows each generation an opportunity to chart a course for the firm. Setting business goals as a family will ensure that everyone has a clear picture of the company's future. A strategic plan is long-term in nature and focuses on where you want the business to be at some future date.

Q: What is a family strategic plan?

A: The family strategic plan establishes policies for the family's role in the business and is needed to maintain a healthy, viable business. For example, it should include the creed or mission statement that spells out your family's values and basic policies for the business, and it may include an entry and exit policy that outlines the criteria for working in the business. The plan should consider which family members desire to have a part in management of the business versus those who desire a more passive role.

Q: What is an estate plan?

A: An estate plan is a written document that outlines the disposal of one's estate and includes such things as a will, trust, power of attorney, and a living will. An estate plan is critical for the family and the business because, without it, you will pay higher estate taxes than necessary, allocating less of the estate to your heirs. The estate plan should be used in conjunction with the succession plan to see that the family business is transferred in a tax effective manner.

Q: What is a succession plan?

A: A succession plan identifies key individuals who will be groomed to take over the business when the time comes. It also outlines how succession will occur and how to know when the successor is ready. Having a succession plan in place goes a long way toward easing the founding or current generation's concerns about transferring the firm.

How do I know whether I have what it takes to run my own business?

Before starting out, list your reasons for wanting to go into business. Some of the most common reasons for starting a business include wanting to be self-employed, wanting financial and creative independence, and wanting to maximize your skills and knowledge.

When determining what business is "right for you," consider what you like to do with your time, what technical skills you have, recommendations from others, and whether any of your hobbies or interests are marketable. You must also decide what kind of time commitment you're willing to make to running a business.

Then you should do research to identify the niche your business will fill. Your research should address such questions as what services or products you plan to sell, whether your idea fits a genuine need, what competition exists, and how you can gain a competitive advantage. Most importantly, can you create a demand for your business?

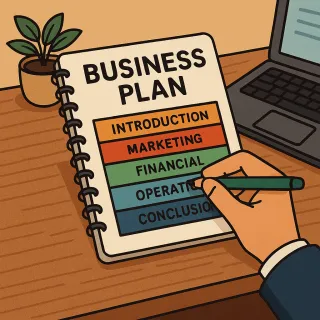

What should I include in a business plan?

The following outline of a typical business plan can serve as a guide that you can adapt to your specific business:

Introduction

Marketing

Financial Management

Operations

Concluding Statement

Q: What should be included in the introduction to my business plan?

A: The introductory section of your business plan should give a detailed description of the business and its goals, discuss its ownership and legal structure, list the skills and experience you bring to the business, and identify the competitive advantage your business possesses.

Q: What should be included in the marketing section of my business plan?

A: In the marketing section, you should discuss what products/services your business offers and the customer demand for them. Furthermore, this section should identify your market and discuss its size and locations. Finally, you should explain various advertising, marketing, and pricing strategies you plan to utilize.

Q: What should be included in the financial management section of my business plan?

A: In this section, explain the source and amount of initial equity capital. Also, develop a monthly operating budget for the first year as well as an expected return on investment, or ROI, and monthly cash flow for the first year. Next, provide projected income statements and balance sheets for a two-year period, and discuss your break-even point. Explain your personal balance sheet and method of compensation. Discuss who will maintain your accounting records and how they will be kept. Finally, provide "what if" statements that address alternative approaches to any problem that may develop.

Q: What should be included in the operations section of my business plan?

A: This section explains how the business will be managed on a day-to-day basis. It should cover hiring and personnel procedures, insurance, lease or rent agreements. It should also account for the equipment necessary to produce your products or services and for production and delivery of products and services.

Q: What should be included in the concluding statement of my business plan?

A: In the ending summary statement, summarize your business goals and objectives and express your commitment to the success of your business. Also, be specific as to how you plan to achieve your goals.

Is a home-based business right for me?

To succeed, your business must be based on something greater than a desire to be your own boss: an honest assessment of your own personality, an understanding of what's involved, and a lot of hard work.

You have to be willing to plan ahead and then make improvements and adjustments along the road. Overall, it is important that you establish a professional environment in your home; you should even set up a separate office in your home, if possible.

What legal requirements might affect a home-based business?

A home-based business is subject to many of the same laws and regulations affecting other businesses. Be sure to consult an attorney and your state department of labor to find out which laws and regulations will affect your business. For instance, be aware of your city's zoning regulations. Also, certain products may not be produced in the home.

Most states outlaw home production of fireworks, drugs, poisons, explosives, sanitary or medical products, and toys. Some states also prohibit home-based businesses from making food, drink, or clothing.

In terms of registration and accounting requirements, you may need a work certificate or a license from the state, a sales tax number, a separate business telephone, and a separate business bank account.

Finally, if your business has employees, you are responsible for withholding income and social security taxes, and for complying with minimum wage and employee health and safety laws.

How can I avoid running into cash flow problems in my small business?

Failure to properly plan cash flow is one of the leading causes of small business failures. Experience has shown that many small business owners lack an understanding of basic accounting principles. Knowing the basics will help you better manage your cash flow.

A business's monetary supply can exist either as cash on hand or in a business checking account available to meet expenses. A sufficient cash flow covers your business by meeting obligations (i.e., paying bills), serving as a cushion in case of emergencies, and providing investment capital.

The Operating Cycle

The operating cycle is the system through which cash flows, from the purchase of inventory through the collection of accounts receivable. It measures the flow of assets into cash. For example, your operating cycle may begin with both cash and inventory on hand. Typically, additional inventory is purchased on account to guarantee that you will not deplete your stock as sales are made.

Your sales will consist of cash sales and accounts receivable - credit sales. Accounts receivable are usually paid 30 days after the original purchase date. This applies to both the inventory you purchase and the products you sell. When you make payment for inventory, both cash and accounts payable are reduced. Thirty days after the sale of your inventory, receivables are usually collected, which increases your cash. Now your cash has completed its flow through the operating cycle and is ready to begin again

Cash-flow analysis should show whether your daily operations generate enough cash to meet your obligations, and how major outflows of cash to pay your obligations relate to major inflows of cash from sales. As a result, you can tell if inflows and outflows from your operation combine to result in a positive cash flow or in a net drain. Any significant changes over time will also appear.

A monthly cash-flow projection helps to identify and eliminate deficiencies or surpluses in cash and to compare actual figures to past months. When cash-flow deficiencies are found, business financial plans must be altered to provide more cash. When excess cash is revealed, it might indicate excessive borrowing or idle money that could be invested. The objective is to develop a plan that will provide a well-balanced cash flow.

What steps can I take to improve my business cash flow?

To achieve a positive cash flow, you must have a sound plan. Your business can increase cash reserves in a number of ways:

Collecting receivables: Actively manage accounts receivable and quickly collect overdue accounts. Revenues are lost when a firm's collection policies are not aggressive.

Tightening credit requirements: As credit and terms become more stringent, more customers must pay cash for their purchases, thereby increasing the cash on hand and reducing the bad-debt expense. While tightening credit is helpful in the short run, it may not be advantageous in the long run. Looser credit allows more customers the opportunity to purchase your products or services.

Manipulating price of products: Many small businesses fail to make a profit because they erroneously price their products or services. Before setting your prices, you must understand your product's market, distribution costs, and competition. Monitor all factors that affect pricing on a regular basis and adjust as necessary.

Taking out short-term loans: Loans from various financial institutions are often necessary for covering short-term cash-flow problems. Revolving credit lines and equity loans are common types of credit used in this situation.

Increasing your sales: Increased sales would appear to increase cash flow. However, if large portions of your sales are made on credit, when sales increase, your accounts receivable increase, not your cash. Meanwhile, inventory is depleted and must be replaced. Because receivables usually will not be collected until 30 days after sales, a substantial increase in sales can quickly deplete your firm's cash reserves.

Should I keep a cash reserve in my small business?

You should always keep enough cash on hand to cover expenses and as an added cushion for security. Excess cash should be invested in an accessible, interest-bearing, low-risk account, such as a savings account, short-term certificate of deposit or Treasury bill.

Choosing a Professional

When should I hire a lawyer?

For certain legally complex or time-consuming disputes or problems, there is no doubt that a lawyer is necessary. For example, if you want a will prepared, or a more complex business deal handled, you will need to hire a lawyer. And, if a court case is involved (other than a simple, routine matter), you'll almost always need a lawyer.

When deciding whether to hire an attorney, consider the following:

Does the matter involve a complex legal issue or is it likely to go to court? Is a large amount of money, property, or time involved? These factors indicate that you need to hire a lawyer.

Is there a form or self-help book available that you can use instead of hiring a lawyer? You may be able to solve certain problems with only minimal assistance.

Are there any non-lawyer legal resources available to assist you?

Unlike more complex transactions, some transactions can be handled without a lawyer. For instance, a living will can often be prepared with the help of organizations such as the American Association of Retired Persons (AARP). Non-profits that deal with retired and elderly persons may also be able to provide you with the necessary paperwork to create a living will in your state, as well as additional information and/or assistance in completing the form properly.

How would I handle a dispute on my own?

Many disputes can be resolved by writing letters or negotiating with the other party on your own, or by using arbitration or mediation. Legal self-help manuals and seminars can provide you with the tools to handle a portion of, or the entire, dispute.

Tip: Consider hiring an attorney to review papers or provide advice, rather than fully representing you.

Negotiating on your own. Negotiating on your own behalf is often the best way to solve minor disputes. Visit your local library or search online for resources that explain the best way to negotiate a dispute.

Tip: Before starting the negotiation process, it's usually a good idea to familiarize yourself with legal issues that might come up by calling a legal hot-line or consulting other sources of information.

Mediation or arbitration. Dispute resolution centers have been established in every state. Most specialize in helping to resolve problems in the areas of consumer complaints, landlord/tenant disputes, and disagreements between neighbors or family members.

During the mediation process, a neutral person assists the two sides in discussing their differences and helps them possibly reach an agreement. In an arbitration setting, the neutral third party conducts a more formal process and makes a decision (usually written) after listening to both sides.

If both parties agree to it, using a dispute resolution center or a private mediation center is a lower-cost alternative to bringing a lawsuit to court or hiring an attorney to represent you during a negotiation process.

Small claims court. Small claims court may be appropriate if you have a monetary claim for damages within the limits set by your state (usually $1,000 to $5,000). These courts are more informal and involve less paperwork than regular courts. If you file in small claims court, be prepared to act as your own attorney, gathering necessary evidence, researching the law, and presenting your story in court.

How do I find a good lawyer?

The first step is to compile a list of names. Ask relatives, friends, clergy, social workers, or your doctor for recommendations. State bar associations usually have lawyer referral lists organized by specialty. Martindale-Hubbell also has a comprehensive lawyer referral service. For specific groups such as persons with disabilities, older persons, or victims of domestic violence consult a community lawyer referral services. The court and your banker may also be good referral sources. Finally, don't forget the yellow pages of the telephone book, which often lists lawyers according to their specialties.

Tip: If you use a referral service, ask how attorneys are chosen to be listed with that particular service. Many services make referrals to all lawyers who are members (regardless of type and level of experience) of a particular organization.

Tip: Be aware that many bar associations have committees that conduct training or public service work in various areas of specialty. An attorney serving on one of these committees could have the expertise you are looking for.

After developing a list of potential lawyers, interview them initially by telephone to narrow down the list and then arrange face-to-face interviews.

What questions should I ask?

Before committing yourself to a consultation, ask potential candidates the following questions:

Do you provide a free consultation for the initial interview?

How long have you been in practice?

What percentage of your cases is similar to my type of legal problem? (A lawyer with experience in handling cases like yours will be more efficient).

Can you provide me with any references, such as trust officers in banks, other attorneys, or clients?

Do you represent any clients or special-interest groups that might cause a conflict of interest?

What type of fee arrangement do you require? Are the fees negotiable?

What information should I bring with me to the initial consultation?

Follow up your phone calls by scheduling interviews with at least two of the attorneys. Don't feel embarrassed about selecting only the best candidates or canceling appointments with some of the attorneys after you complete your initial phone calls.

Next, interview the candidates. Come prepared with a brief summary of your immediate case (including dates and facts) as well as a list of general questions for the attorney. The purpose of the interview is twofold: (1) to decide if the attorney has the necessary experience and is available to take your case; and, (2) to decide if you are comfortable with the fee arrangement and, most importantly, comfortable working with the attorney.

What legal fee arrangements are best for me?

The market rate for any given legal service varies by locality. A "fair" fee is what seems fair to you, based on your knowledge of going rates. Whether you are comfortable with a fee is likely to be based on the following factors:

How much you can afford

Whether the case is routine or requires special expertise

The range of attorney rates for this type of case in your area

How much work can you can do on the case yourself

The most common types of fee arrangements used by lawyers are listed below.

Flat fee. The lawyer will charge you a specific total fee for your case. A flat fee is usually offered only if your case is relatively simple or routine.

Note: While lawyers will not set a flat fee for litigation, they can usually give you a good estimate of the costs at each stage.

Tip: Ask if photocopying, typing, and other out-of-pocket expenses are covered by this flat fee.

Hourly rate. Attorneys charge by the hour (or portion of an hour). For instance, if your attorney's fee is $100 per hour, and he or she works ten hours, the cost will be $1,000. Some attorneys charge a higher rate for court work and less per hour for research or case preparation. And, as a rule, large law firms usually charge more than small law firms and attorneys in urban areas often charge more per hour than attorneys practicing in rural areas.

Tip: If you agree to an hourly rate, be sure to find out how much experience your attorney has had with your type of case. A less experienced attorney will usually require more time to research your case, although he or she may charge a lower hourly rate.

Tip: Ask what is included in the hourly rate. If other staff such as secretaries, messengers, paralegals, and law clerks will be working on your case, find out how their time will be charged to you? Ask about costs and out-of-pocket expenses, which are usually billed in addition to the hourly rate.

Contingency fee. Under this arrangement, the attorney's fee is based on a percentage of what you are awarded in the case. If you lose the case, the attorney does not get a fee, although you will still have to pay expenses. A one-third fee is common.

Tip: Ask whether the lawyer will calculate the fee before or after the expenses. This can make a substantial difference, since calculating the percentage of the attorney's fee after the expenses have been deducted increases the amount of money you receive.

How can I save money on legal fees?

It is important to remember that a lawyer's fees are often negotiable, but your lawyer is unlikely to invite you to bargain over fees! Here are some tips for saving ensuring the cost-effectiveness of legal fees.

Comparison shop for flat fees on simple cases.

Ask about the billing method for hourly rates. A written agreement specifying the fee arrangement and the work involved is the best way to be clear about the total cost of the case.

Choose a lawyer with the appropriate qualifications. Most legal work is relatively routine in nature and often has more to do with knowing which form to fill out and which county clerk will process it most quickly.

Offer to perform some of the work.

Hire the attorney to act as a go-between. Some lawyers are open to negotiating a lower fee if you are only looking for their legal expertise to write a letter to the other side to settle.

Hire the attorney to act as your pro se coach. If you want to represent yourself in court (called "appearing pro se"), hire your attorney to act as a pro se coach who will review documents and letters that you prepare and sign.

Choose a lawyer who specializes in what you need.

Prepare for meetings with your attorney.

The more work you do to prepare, the less time your attorney needs to spend (and charge you) for finding the information.

Answer your attorney's questions fully. If your attorney knows all the facts as early as possible in the case, it will save time and money that might be spent later on further investigations or misdirected case development.

If the situation changes, tell your attorney as soon as possible. You don't want your attorney heading in the wrong direction on a case.

Maximize contact with your attorney. Consolidate your questions or information-giving into a single call. Unless you have a specific reason for doing so, pass on information in writing or to other office staff rather than speaking directly with the attorney.

Examine your bill. Request that your attorney bill you on a regular basis. Even if you have agreed on a contingency fee and will not actually pay the expenses until the case is settled, you should periodically examine the expenses. Question any items that you do not understand or that are not covered in your fee agreement.

Employee Benefits

As a Small Employer What Do I Need to Know about Employee Benefits?

The employer must pay in whole or in part for certain legally mandated benefits and insurance coverage, including Social Security, unemployment insurance, and workers' compensation. Funding for the Social Security program comes from mandatory contributions from employers, employees and self-employed persons into an insurance fund that provides income during retirement years.

Full retirement benefits normally become available at age 66 for people born after 1943, and age 67 for those born in 1960 or later. Other aspects of Social Security deal with survivor, dependent and disability benefits, Medicare, Supplemental Security Income (SSI) and Medicaid. Unemployment insurance benefits are payable under the laws of individual states from the Federal-State Unemployment Compensation Program.

Workers' compensation provides benefits to workers disabled by occupational illness or injury. Each state mandates coverage and provides benefits. In most states, private insurance or an employer self-insurance arrangement provides the coverage. Some states mandate short-term disability benefits as well.

A comprehensive benefit plan might include the following elements health insurance, disability insurance, life insurance, a retirement plan, flexible compensation, and sick, personal, and vacation leave. A benefit plan might also include bonuses, service awards, reimbursement of employee educational expenses and perquisites appropriate to employee responsibility.

As an employer, before you implement any benefit plan, it's important to decide what you're willing to pay for this coverage. You may also want to seek employee input on what benefits interest them. For instance, is a good medical plan more important than a retirement plan? Furthermore, you must decide whether it is more important to protect your employees from economic hardship now or in the future. Finally, you must decide if you want to administer the plan or have the insurance carrier do it.

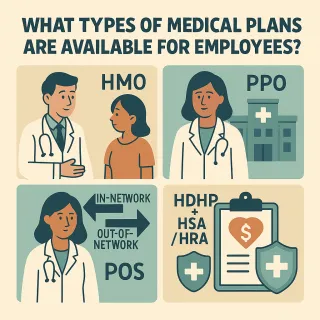

What Types of Medical Plans are Available for Employees?

Today, most health insurance falls under what is called "managed care" in which you pay monthly premiums, as well as co-pays and deductibles. The four main types of health insurance are briefly described below. For more information contact your plan administrator.

In addition, due to the passage of the Affordable Care Act of 2010, which was upheld by the Supreme Court in July 2012, starting in 2014 states may opt to create a "healthcare exchange" that enable individuals and small businesses to compare health plans, get answers to questions, find out if they are eligible for tax credits for private insurance or health programs like the Children's Health Insurance Program (CHIP), and enroll in a health plan that meets their needs.

Health maintenance organizations (HMOs) provide health care for their members through a network of hospitals and physicians. Comprehensive benefits typically include preventive care, such as physical examinations, well baby care and immunizations, and stop-smoking and weight control programs. The choice of primary care providers is limited to one physician within a network; however, there is frequently a wide choice for the primary care physician.

A preferred provider organization (PPO) is a network of physicians and/or hospitals that contracts with a health insurer or employer to provide health care to employees at predetermined discounted rates. PPOs offer a broad choice of health care providers.

Point of Service (POS) health care plans are similar to HMOs in that you choose a primary-care doctor from the plan's network, but you must have a referral in order to see in-network specialists. You can also see out of network providers as long as you get a referral first.

Another option to consider is a high-deductible health insurance combined with a health-savings account (HSA) or a health reimbursement arrangement (HRA). By law, the two must be linked.

NOTE: HSAs should not be confused with FSAs (Flexible Spending Accounts). Money that you set aside in a health savings account or a health reimbursement arrangement to pay for certain medical expenses is tax-free. HSAs must be linked to a high-deductible health insurance plan, and HRAs often are. (For preventive care, such as cancer screenings, you might not have to pay the deductible first.) Typically, a special debit type card is used for the HSA or HRA account to keep track of expenses and payments.

What Types of Disability Benefits do Companies Provide to Employees?

A disability plan provides income replacement for the employee who cannot work due to illness or accident. These plans are either short term or long term and are distinct from workers' compensation because they pay benefits for non-work-related illness or injury.

Short-term disability (STD) is usually defined as an employee's inability to perform the duties of his or her normal occupation. Benefits may begin on the first or the eighth day of disability and are usually paid for a maximum of 26 weeks. The employee's salary determines the benefit level, ranging from 60 to 80 percent of pay.

Long-term disability (LTD) benefits usually begin after short-term benefits conclude. LTD benefits continue for the length of the disability or until normal retirement. Again, benefit levels are a percentage of the employee's pay, usually between 60 and 80 percent. Social Security disability frequently offsets employer-provided LTD benefits. Thus, if an employee qualifies for Social Security disability benefits, these are deducted from benefits paid by the employer.

What Types of Life Insurance Plans are Available for Employees?

Traditionally, life insurance pays death benefits to beneficiaries of employees who die during their working years. Most employers purchase a group life policy for their employees. Typically an employee is provided with life insurance coverage that is at least equal to their yearly salary. For example, an employee who makes $50,000 per year would receive $50,000 of coverage. The employer is responsible for the premium but may require employees to pay part of the premium cost.

What is Self-Insurance?

With self-insurance, the business predetermines and then pays a portion or all of the medical expenses of employees in a manner similar to that of traditional healthcare providers. Funding comes through the establishment of a trust or a simple reserve account and a self-insured employer assumes the risk for paying the health care claim costs for its employees.

As with other health care plans, the employee generally pays a portion of the cost of premiums. Catastrophic coverage is usually provided through a "stop-loss" policy, a type of coinsurance purchased by the company. The plan may be administered directly by the company or through an administrative services contract. Businesses with self-insured health plans are not subject to taxes, benefit requirements, profit limits, or other provisions of the Affordable Care Act.

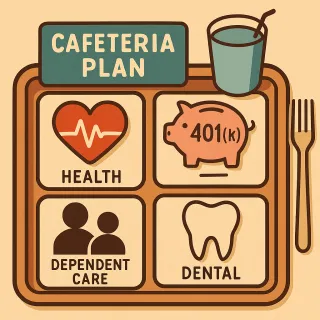

What is a "Cafeteria Plan?"

The idea behind cafeteria plans is that amounts which would otherwise be taken as taxable salary are applied, usually tax-free, for needed services like health or child care. Besides saving employee income and social security taxes, salary diverted to cafeteria plan benefits isn't subject to social security tax on the employer. With a cafeteria plan, employees can choose from several levels of supplemental coverage or different benefit packages. These can be selected to help employees achieve personal goals or meet differing needs, such as health coverage (family, dental, vision), retirement income (401(k) plans) or specialized services (dependent care, adoption assistance, legal services - legal services amounts are taxable).

Recordkeeping

What kind of records do I need to keep in my business?

Complete and accurate financial record keeping is crucial to your business success. Good records provide the financial data that helps you operate more efficiently. Accurate and complete records enable you to identify all your business assets, liabilities, income, and expenses. That information helps you pinpoint both the strong and weak phases of your business operations.

Moreover, good records are essential for the preparation of current financial statements, such as the income statement (profit and loss) and cash-flow projection. These statements, in turn, are critical for maintaining good relations with your banker. Finally, good records help you avoid underpaying or overpaying your taxes. In addition, good records are essential during an Internal Revenue Service audit, if you hope to answer questions accurately and to the satisfaction of the IRS.

To assure your success, your financial records should show how much income you are generating now and project how much income you can expect to generate in the future. They should inform you of the amount of cash tied up in accounts receivable. Records also need to indicate what you owe for merchandise, rent, utilities, and equipment, as well as such expenses as payroll, payroll taxes, advertising, equipment and facilities maintenance, and benefit plans for yourself and employees. Records will tell you how much cash is on hand and how much is tied up in inventory. They should reveal which of your product lines, departments, or services are making a profit, as well as your gross and net profit.

The Basic Recordkeeping System

A basic record-keeping system needs a basic journal to record transactions, accounts receivable records, accounts payable records, payroll records, petty cash records, and inventory records.

An accountant can develop the entire system most suitable for your business needs and train you in maintaining these records on a regular basis. These records will form the basis of your financial statements and tax returns.

What do I need to know about automating part or all of my business?

You must have a clear understanding of your firm's long- and short-range goals, the advantages and disadvantages of all of the alternatives to a computer and, specifically, what you want to accomplish with a computer. Compare the best manual (non-computerized) system you can develop with the computer system you hope to get. It may be possible to improve your existing manual system enough to accomplish your goals. In any event, one cannot automate a business without first creating and improving manual systems.

Business Applications Performed by Computers

A computer's multiple capabilities can solve many business problems from keeping transaction records and preparing statements and reports to maintaining customer and lead lists, creating brochures, and paying your staff. A complete computer system can organize and store many similarly structured pieces of information, perform complicated mathematical computations quickly and accurately, print information quickly and accurately, facilitate communications among individuals, departments, and branches, and link the office to many sources of data available through larger networks. Computers can also streamline such manual business operations as accounts receivable, advertising, inventory, payroll, and planning. With all of these operations, the computer increases efficiency, reduces errors, and cuts costs.

Computer Business Applications

Computers also can perform more complicated operations, such as financial modeling programs that prepare and analyze financial statements and spreadsheet and accounting programs that compile statistics, plot trends and markets and do market analysis, modeling, graphs, and forms. Various word processing programs produce typewritten documents and provide text-editing functions while desktop publishing programs enable you to create good quality print materials on your computer. Critical path analysis programs divide large projects into smaller, more easily managed segments or steps.

How can I ensure that I'm choosing the right computer system?

To computerize your business you need to choose the best programs for your business, select the right equipment, and then implement the various applications associated with the software. In addition, application software is composed of programs that make the computer perform particular functions, such as payroll check writing, accounts receivable, posting or inventory reporting and are normally purchased separately from the computer hardware. QuickBooks is a good example of this type of software.

To determine your requirements, prepare a list of all functions in your business. in which speed and accuracy are needed for handling volumes of information. These are called applications.

For each of these applications make a list of all reports that are currently produced. You should also include any pre-printed forms such as checks, billing statements or vouchers. If such forms don't exist, develop a good idea of what you want - a hand-drawn version will help. For each report list the frequency with which it is to be generated, who will generate it and the number of copies needed. In addition to printed matter, make a list of information that you want to display on the computer video screen (CRT).

For all files you are keeping manually or expect to computerize list, identify how you retrieve a particular entry. Do you use account numbers or are they organized alphabetically by name? What other methods would you like to use to retrieve a particular entry? Zip code? Product purchased? Indeed, the more detailed you are, the better your chance of finding programs compatible with your business.

How can I successfully implement a new computer system?

When implementing computer applications for your business, problems are inevitable, but proper planning can help you avoid some and mitigate the effects of others. First, explain to each affected employee how the computer will change his or her position. Set target dates for key phases of the implementation, especially the last date for format changes. Be sure the location for your new computer meets the system's requirements for temperature, humidity, and electrical power. Prepare a prioritized list of applications to be converted from manual to computer systems, and then train, or have the vendors train, everyone who will be using the system.

After installation, each application on the conversion list should be entered and run parallel with the preexisting, corresponding manual system until you have verified that the new system works.

System Security

If you will have confidential information in your system, you will want safeguards to keep unauthorized users from stealing, modifying or destroying the data. You can simply lock up the equipment, or you can install user identification and password software.

Data Safety

The best and cheapest insurance against lost data is to back up information on each diskette regularly. Copies should be kept in a safe place away from the business site. Also, it is useful to have and test a disaster recovery plan and to identify all data, programs, and documents needed for essential tasks during recovery from a disaster.

Finally, be sure to employ more than one person who can operate the system, and ensure that all systems are continually monitored.

Travel and Entertainment

Can I deduct the cost of meals on days I call on customers or clients away from my office?

Generally not. Usually, you can only deduct costs of meals when you're away from home overnight. Even so, the deduction is allowed only to the extent of 50 percent of the cost of meals and related tips. Also, because business-related entertainment expenses were eliminated under tax reform, starting in 2018, the deduction for meals at entertainment events is deductible (at 50%) only when costs for meals are itemized separately from entertainment costs.For tax years 2021 and 2022, the deduction was allowed at 100 percent if purchased from a restaurant (eat-in or take-out).

Must I report employer reimbursements for travel, entertainment and meals?

Under tax reform, miscellaneous itemized deductions subject to the 2-percent floor were eliminated for tax years 2018-2025. However, prior to tax reform (i.e., for tax years prior to 2018), the following applied:It depends. If you give your employer a detailed expense accounting, return any excess reimbursement, and meet other requirements, you don't have to report the reimbursement and you don't deduct the expenses. This means that any deduction limits are imposed on your boss, not you, and the 2-percent limit on miscellaneous itemized deductions won't affect your travel, entertainment and meals costs.

What are the limits on deductible travel, entertainment and meals costs?

Prior to tax reform (i.e., for tax years before 2018), the deduction for business entertainment and business meals could not exceed 50 percent of the cost. Note that due to the coronavirus pandemic, business-related meals purchased from a restaurant (eat-in or take-out) were deductible at 100 percent for tax years 2021 and 2022. There are no dollar limits. Expenses must be "ordinary and necessary" (meaning appropriate and helpful) and not "lavish or extravagant," but this doesn't bar deluxe accommodations, travel or meals. Additionally, there were additional special limitations on skyboxes and luxury water travel.

Starting in 2018 and continuing through tax year 2025, no deduction is allowed for business entertainment. Tax reform also eliminated deductions for expenses relating to sporting events such as those for skybox expenses (previously 50%), tickets to sporting events (previously 50%), and transportation to and from sporting events (previously 50%).

Can I deduct living expenses on temporary assignment away from the area where I live and work?

Yes. Living expenses at the temporary work site are away from home travel expenses. An assignment is temporary if it's expected to last no more than a year. If it's expected to last more than a year, the new area is your tax home, so you can't deduct expenses there as away from home travel.

What expenses can I deduct while traveling away from home?

A wide range of expenses can be deducted while traveling away from home.

Here are the main ones:

Transportation fares, or actual costs (or a standard per mile rate) of using your own vehicle. Also, transportation costs of getting around in the work area-to and from hotels, restaurants, offices, terminals, etc.

Lodging and meals (subject to the 50 percent limit on meals; 100 percent in 2021 and 2022)

Phone, fax, laundry, baggage handling

Tips related to the above

What can't be deducted as travel expenses?

The following travel expenses cannot be deducted:

Costs of commuting between your residence and a work site, but it's a deductible business trip if your residence is your business headquarters.

Travel as education

Job hunting in a new field or looking for a new business site

What can I deduct for business entertainment?

Prior to 2018 and the passage of the TCJA, the following generally applied:

There should be a business discussion before, during, and after the meals and entertainment.

The deduction for entertainment and meals is limited to 50 percent of the cost. In 2021 and 2022 restaurant meals were deductible at 100 percent.

There were further limitations for club dues, entertainment facilities, and skyboxes.

Spouses of business associates and your own spouse could be included in the entertainment in settings where spouse attendance is customary.

After tax reform, and starting in 2018, the rules changed and the entertainment expense deduction was eliminated entirely with the exception of certain activities such as office holiday parties, which remain 100% deductible. For example, the deduction for business entertainment expenses is eliminated but meals remain deductible at 50 percent (100 percent in 2021 and 2022). In addition, the following now applies:

Entertainment-related Meals. Prior to tax reform expenses for meals purchased during entertainment activities such as meals included at a sporting event were deductible at 50%. Starting in 2018; however, the deduction is eliminated unless the costs of meals are invoiced separately.

Sporting Events. Tax reform eliminated all deductions relating to sporting events including deductions for sky box expenses (previously 50%), tickets to sporting events (previously 50%), tickets to qualified charitable events (previously 100%), and transportation to and from sporting events (previously 50%).

Club Memberships. While there was never a deduction for club dues, business owners were able to take a 50% deduction for expenses incurred at a business, recreational, or social club as long as it was related to their trade or business. Under tax reform, however, that deduction has been eliminated.

How do I prove my travel and entertainment expenses?

If you're an employee who is reimbursed for expenses you'll need to file an expense report for your employer, which is a written accounting of your expense while on travel. If you received a cash advance, you'll also need to return to the employer any amounts in excess of your expenses.

Some per diem arrangements and mileage allowances called "accountable plans" take the place of detailed accounting to the employer, if time, place and business purpose are established.

For tax years 2018 through 2025, miscellaneous itemized deductions (Form 1040, Schedule A) have been eliminated due to tax reform (Tax Cuts and Jobs Act of 2017). Prior to tax reform (i.e., tax years prior to 2018), the following held true:

Where expenses aren't fully reimbursed by your employer or excess reimbursements aren't returned, detailed substantiation to IRS is required and, if you're an employee, your deductions are subject to the 2-percent floor on miscellaneous itemized deductions. In addition, your expense records should be "contemporaneous," that is, recorded close to the time expenses are incurred.

Marketing and Pricing

How do I research whether my small business' product or service will sell?

Market research is the most critical element of successful business planning because it provides the basic data that will determine if and where you can successfully sell your product or service and how much to charge. It is a process that involves scrutinizing your competition and your customer base, and interviewing potential suppliers.

There are a number of benefits to conducting market research such as helping you create primary and alternative sales approaches to a given market, making profit projections from a more accurate base, organizing marketing activities, developing critical short/mid-term sales goals, and establishing the market's profit boundaries, but first, you must define your goals and organize the collection/analysis process.

What market research questions should I ask?

Your research questions should revolve around the demographic data of your customers such as age, location, and income (what they can afford). Your research should also address larger questions such as what type of demand there is for your product, how you might generate demand. In addition, you will want to find out how many competitors provide the same service or product and whether you can you effectively compete with regard to price, quality, and delivery.

You also might want to ask yourself whether you can price the product or service so as to assure a profit. Finally, it is helpful to understand the general economy of your service or product area and the areas within your market that are declining or growing.

What costs should I consider when determining how much to charge for my products or services?

Every component of a service or product has a different, specific cost. Many small firms fail to analyze each component of their commodity's total cost, therefore failing to price profitably. Once this analysis is done, prices can be set to maximize profits and eliminate any unprofitable service. Cost components include material, labor and overhead costs.

Material Costs. These are the costs of all materials found in the final product.

Labor Costs. Labor costs are the costs of the work that goes into the manufacturing of a product. The direct labor costs are derived by multiplying the cost of labor per hour by the number of person-hours needed to complete the job. Remember to use not only the hourly wage but also the dollar value of fringe benefits. These include social security, workers' compensation, unemployment compensation, insurance, retirement benefits, etc.

Overhead Costs. Overhead costs are any costs that are not readily identifiable with a particular product. These costs include indirect materials, such as supplies, heat, and light, depreciation, taxes, rent, advertising, transportation, and insurance.

Overhead costs also cover indirect labor costs, such as clerical, legal and janitorial services. Be sure to include shipping, handling, and/or storage as well as other cost components.

Part of the overhead costs must be allocated to each service performed or product produced. The overhead rate can be expressed as a percentage or an hourly rate. It is important to adjust your overhead costs annually. Charges must be revised to reflect inflation and higher benefit rates. It's best to project the costs semiannually, including increased executive salaries and other projected costs.

Business Forms of Organization

Which kinds of business organization or business entity will limit my liability to business creditors?

Corporations, limited liability companies (LLCs), limited partnerships, and limited liability partnerships (LLPs) are the three most common business entities that limit liability. General partnerships and sole proprietorships don't limit owners' liability. Limited partnerships limit the liability of some partners (limited partners) and not others (general partners).

What is the "corporate double tax" and how can it be avoided?

Double taxation of corporations results in a significant tax burden on corporate income. Often referred to as the "corporate double tax," it occurs when a business corporation (or an entity treated for tax purposes as a business corporation) pays a federal tax on its income, and tax is also paid by its owners in the form of individual income tax on capital gains and dividends when they collect corporate profits.

Double taxation occurs even if the corporation retains its after-tax earnings (as opposed to distributing them as dividends) because the value of the stock increases to reflect an increase in assets held by the corporation. Shareholders that decide to sell their stock will realize a capital gain and pay tax on that gain.

The tax on the corporation is called an "entity level tax" and an entity so taxed is called a "C-corporation" (C-corp). The double tax can be avoided one of two ways:

By electing to be an S-corp. While this doesn't change its nature under state business law, but in most cases eliminates federal tax at the corporate level.

By postponing profits distributions to corporate owners, the second tax (on the owners) can be postponed.

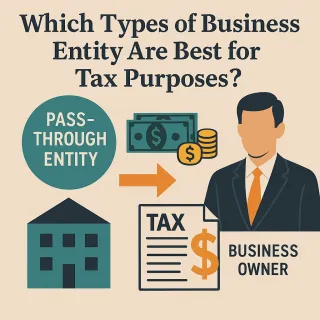

Which types of business entity are best for tax purposes?

It depends. Generally speaking, the "pass-through" type of entity saves tax overall by eliminating tax at the entity level. pass-through entity owners are taxed directly on their share of entity profits. Another pass-through advantage is that owners can take tax deductions for startup or operating losses, against their income from investments or other businesses.

Which are the "pass-through" entities?

You have much control over whether the entity you choose is treated as a pass-through entity for federal tax purposes (see below), but the leading pass-through forms are general partnerships, limited partnerships, LLPs, LLCs, S-corps, and sole proprietorships.

If your business is in the form of a partnership (any type) or limited liability company, you may choose whether your business is treated for tax purposes as a corporation or a partnership (or, if you're the only one in the LLC, as a corporation or disregarded for tax purposes). Tax and business advisors call this choice the "check-the-box" system. If it's actually incorporated, or you choose to have it treated as a corporation, you may qualify to have it treated as a pass-through by electing S-corp status.

Your choice under check-the-box is binding. That is, if you choose one entity (say, corporation) in one year and another (say, partnership) the next year, you must pay tax as if you sold last year's entity and put the proceeds into this year's.

What entities will let me both limit my liability and avoid the double tax?

S-corps (usually) and all of the following, assuming that you don't choose to have them treated as corporations: LLCs; LLPs; and limited partnerships, for the limited partners. For sole owners, the choice is limited to S-corps or, in states that allow single-owners, LLCs.

What's so great about limited liability companies (LLCs)?

LLCs combine limited liability with pass-through tax treatment. They can offer benefits unavailable from S-corps, their nearest rival (for businesses other than professional practices). The key benefits:

A way to allocate certain tax benefits disproportionately among owners.

Opportunity for greater loss deductions.

Avoiding or reducing tax when a new owner joins the business or when distributions are made to owners in business liquidation.

State law varies when it comes to allowing single-owner LLCs; some states allow it and some states don't. Where it is allowed, the owner can choose under check-the-box rules to have the LLC disregarded for tax purposes (without losing LLC limited liability), and pay tax directly on LLC income.

In states where single member LLCs aren't allowed S-corps are a good alternative, and they can also postpone tax, as compared to LLCs, where the business is to be bought out by a corporate giant.

What special considerations are there if my business is a professional practice?

Limitation of liability, especially malpractice liability, is a major concern. No entity will protect you against liability for your own malpractice. But LLCs, Professional Limited Liability Companies (PLLCs), and LLPs, where available for professional practices, will protect you against liability for malpractice of co-owner professionals in the firm, and maybe (depending on state law) for other debts. Professional Corporations (PCs) may not protect against liability for a co-owner's malpractice, depending on state law.

The tax rules governing those in LLCs, PLLCs, and LLPs are about the same, and somewhat more liberal than those for PCs.

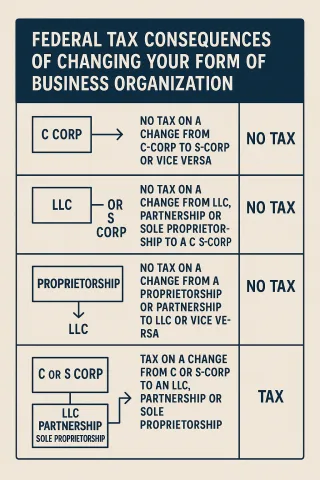

What are the federal tax consequences of changing your form of business organization?

This is a critical decision that should be studied carefully with professional guidance, but briefly stated:

There's no tax on a change from C-corp to S-corp or vice versa.

There is no tax on a change from LLC, partnership or sole proprietorship to a C or S-corp.

There is no tax on a change from a proprietorship or partnership to LLC or vice versa.

There is a tax on a change from C or S-corp to an LLC, partnership or sole proprietorship.

Do state business entity rules follow federal tax rules?

Keep in mind the difference between state business law and state tax law. The tax status you choose for your entity under the federal check-the-box system doesn't make it that entity for state business law purposes. So, for example, choosing corporate tax treatment for a partnership won't bring corporate limited liability.

There is a trend for states to treat the entity chosen under federal check-the-box as the entity recognized for state tax purposes, but this is optional with the state.

State law may accept pass-through status for an entity (such as an S-corp or an LLC) and still impose a tax of some kind on the entity.

Incorporating

What is a corporation?

A corporation is a legal entity that exists separately from its owners. Creation of a corporation occurs when properly completed articles of incorporation are filed with the correct state authority, and all fees are paid.

What is the difference between an "S" corporation and a "C" corporation?

All corporations start as "C" corporations and are required to pay income tax on taxable income generated by the corporation. A C-corporation becomes an S-corporation by completing and filing federal form 2553 with the IRS. An S-corporation's net income or loss is "passed-through" to the shareholders and are included in their personal tax returns. Because income is NOT taxed at the corporate level, there is no double taxation as with C-corporations. Subchapter S-corporations, as they are also called, are restricted to having no more than 100 shareholders.

Do I need an attorney to incorporate?

An attorney is not a legal requirement for incorporating a business in any state except South Carolina, where a signature by a South Carolina attorney licensed to practice in the state is required on articles of incorporation. In every other state, you can prepare and file the articles of incorporation yourself. However, if you are unsure of what steps your business should take and you don't have the time to research the matter yourself, a consultation with a good corporate attorney is often well worth the money you spend.

How do I know if my name is available?

We will request your two top name choices. We will check these as part of your order. If neither of these is available, we will contact you for other name choices.

How do I name my corporation?

First, we recommend that you spend some time coming up with a name for your corporation. Although each state has different rules concerning the naming of your corporation, the most common rule is that it must not be deceptively similar to another already formed company. The corporate name must include a suffix. Some examples are "Incorporated", "Inc.", "Company", and "Corp." However, your state may have different suffix requirements.

What are the benefits of incorporating?

The primary advantage of incorporating is to limit your liability to the assets of the corporation only. Usually, shareholders are not liable for the debts or obligations of the corporation. So if your corporation defaults on a loan, unless you haven't personally signed for it, your personal assets won't be in jeopardy. This is not the case with a sole proprietorship or partnership. Corporations also offer many tax advantages that are not available to sole proprietors.

Some other advantages include:

A corporation's life is unlimited and is not dependent upon its members. If an owner dies or wishes to sell their interest, the corporation will continue to exist and do business.

Retirement funds and qualified retirement plans (like 401k) may be set up more easily with a corporation.

Ownership of a corporation is easily transferable.

Capital can be raised more easily through the sale of stock.

A corporation possesses centralized management.

What is a Registered Agent?

Most every state requires that a corporation has a registered agent. That agent must have a physical location in the formation state. The registered agent can typically be any person (usually a resident of the state) or any properly registered company who is available during normal business hours to receive official state documents or service of process (lawsuit).

How many Directors/Shareholders do I need?

Most states allow for one person to act as shareholder, director, and all officer roles.

How many shares of stock should I choose, and at what par value?

We provide a default of 200 shares, although you can choose any amount you want on all orders. Your par value is not requested on all orders, and is usually expressed as "No Par Value" or some dollar amount per share such as "$1.00" or "$0.10." Some states require that you do not issue your stock for less than the par value. Some states also base their fees on the number of shares authorized, multiplied by the par value.

What is a Federal Tax Identification Number or EIN?

Your corporation is required to have an Employer Identification Number (EIN) also known as your Federal Tax Identification Number so that the IRS can track payroll and income taxes paid by the corporation. But, like a social security number, an EIN is used for most everything the business does. Your bank will require an EIN to open your corporate bank account.

We provide two EIN services:

Basic EIN Service - We prepare and email your SS4 (EIN application) & easy one-page instructions for obtaining your EIN. You need only review, sign and fax or call in the information to the IRS to get your EIN.

Full EIN Service - We actually obtain your company's EIN for you.

What do I need to do AFTER I incorporate?

You must have your initial shareholder(s) meeting to elect your director(s), if your director(s) haven't been designated in the articles. Then, you must have your initial organizational meeting of your directors. At this meeting, you will need to elect your officers, adopt your company's bylaws, and issue your stock (among other actions).

How do I get started?

Once you have decided on a name, order your corporation online. Once we receive your paid order, we verify the availability of your name choices, draft your articles, file them with the state and send you all appropriate documents after they have been filed.

Limited Liability Companies

Who should form an LLC?

You should consider forming an LLC (limited liability company) if you are concerned about personal exposure to lawsuits arising from your business. For example, if you decide to open a store-front business that deals directly with the public, you may worry that your commercial liability insurance won't fully protect your personal assets from potential slip-and-fall lawsuits or claims by your suppliers for unpaid bills. Running your business as an LLC may help you sleep better because it instantly gives you personal protection against these and other potential claims against your business.

Not all businesses can operate as LLCs, however. Businesses in the banking, trust, and insurance industry, for example, are typically prohibited from forming LLCs.

Should I choose an LLC or an S-corporation?

While the S-corporation's special tax status eliminates double taxation, it lacks the flexibility of an LLC in allocating income to the owners.

An LLC may offer several classes of membership interests while an S-corporation may only have one class of stock.

Any number of individuals or entities may own interests in an LLC. However, ownership interest in an S-corporation is limited to no more than 100 shareholders. Also, S-corporations cannot be owned by C-corporations, other S-corporations, many trusts, LLCs, partnerships, or nonresident aliens. Also, LLCs are allowed to have subsidiaries without restriction.

What is an LLC Operating Agreement?

An LLC operating agreement allows you to structure your financial and working relationships with your co-owners in a way that suits your business. In your operating agreement, you and your co-owners establish each owner's percentage of ownership in the LLC, his or her share of profits (or losses), his or her rights and responsibilities, and what will happen to the business if one of you leaves.

Do I need to have an Operating Agreement?

Although most states' LLC laws don't require a written operating agreement, you shouldn't consider starting business without one. Here's why an operating agreement is necessary:

It helps to ensure that courts will respect your personal liability protection by showing that you have been conscientious about organizing your LLC.

It sets out rules that govern how profits will be split up, how major business decisions will be made, and the procedures for handling the departure and addition of members.

It helps to avert misunderstandings between the owners over finances and management.

It keeps your LLC from being governed by the default rules in your state's LLC laws, which might not be to your benefit.

Must I hold LLC meetings?

Although a corporation's failure to hold shareholder or director meetings may subject the corporation to alter ego liability, this is not the case for LLCs in many states. In California for example, an LLC's failure to hold meetings of members or managers is not usually considered grounds for imposing the alter ego doctrine where the LLC's Articles of Organization or Operating Agreement do not expressly require such meetings.

Exceptions to Limited Liability

While LLC owners enjoy limited personal liability for many of their business transactions, it is important to realize that this protection is not absolute. This drawback is not unique to LLCs, however -- the same exceptions apply to corporations. An LLC owner can be held personally liable if he or she:

personally and directly injures someone

personally guarantees a bank loan or a business debt on which the LLC defaults

fails to deposit taxes withheld from employees' wages

intentionally does something fraudulent, illegal, or clearly wrong-headed that causes harm to the company or to someone else, or

treats the LLC as an extension of his or her personal affairs, rather than as a separate legal entity.

This last exception is the most important. In some circumstances, a court might say that the LLC doesn't really exist and find that its owners are really doing business as individuals, who are personally liable for their acts. To keep this from happening, make sure you and your co-owners:Act fairly and legally. Do not conceal or misrepresent material facts or the state of your finances to vendors, creditors, or other outsiders.

Fund your LLC adequately. Invest enough cash into the business so that your LLC can meet foreseeable expenses and liabilities.

Keep LLC and personal business separate. Get a federal employer identification number, open up a business-only checking account, and keep your personal finances out of your LLC accounting books.

Create an operating agreement. Having a formal written operating agreement lends credibility to your LLC's separate existence.

A good liability insurance policy can shield your personal assets when limited liability protection does not. For instance, if you are a massage therapist and you accidentally injure a client's back; your liability insurance policy should cover you. Insurance can also protect your personal assets in the event that your limited liability status is ignored by a court.

In addition to protecting your personal assets in such situations, insurance can protect your corporate assets from lawsuits and claims. Be aware, however, that commercial insurance usually does not protect personal or corporate assets from unpaid business debts, whether or not they're personally guaranteed.

Home Owners

Buying a Home

How much should I spend on my next home?

The first step is to think about how much you can afford to pay out each month for a mortgage payment. Keep in mind that a mortgage payment typically includes property taxes and mortgage insurance as well as the mortgage payment itself. The general rule of thumb is that no more than 30 percent of your gross monthly income should be spent on housing expenses.

If you plan to borrow money from a lender then you might want to consider getting pre-qualified. Pre-qualification is helpful to the buyer for planning purposes because it gives you an estimate of the maximum mortgage amount you can afford based on your current financial situation. Unlike a pre-approval, pre-qualification is not a commitment on the part of the lender, but it does give you an idea of the mortgage amount you probably qualify for. Knowing this information in advance can help you figure out a price range for your new home.

When you're figuring out a price range, don't forget to take into account any amount you apply as part of a down payment. You will want to save as possible for a down payment. The reasons for this are two-fold: first, lenders will not require you to pay for private mortgage insurance if you can come up with a 20 percent down payment; second, the sooner you pay off your mortgage, the better off you are financially.

Once you've figured out a price range let your real estate agent know what it is, but don't be afraid to look at homes that are 15 percent to 20 percent over your price range. In many cases, you will be able to negotiate the price down.

How can I find a good real estate agent when buying a home?

As a home buyer you pay a commission to the agent, so you want to make sure you are getting your money's worth. What you need is an agent who is competent and experienced, and whose way of working is compatible with your own. If you're working with a real estate agent that you feel is not doing his or her best to find you the home you want, then don't hesitate to find a new one.

When looking for a real estate agent ask yourself the following:

Is the Agent Full-Time? Is the Agent Experienced?

Look for an agent with at least a few years of full-time experience. As with many professions, real estate agents acquire most of their skills on the job.

Does the Agent Listen, and Communicate Clearly?

The agent must understand what's important to you in your home purchase and be able to tell you what you need to know about a home.

Is the Agent Willing to Negotiate For You?

To get the best home for the best price you'll have to negotiate with the seller. If the agent is not willing to show you houses that are 20 percent over your price range or to go to bat for you when negotiating with the seller, you should find a new agent.

Is the Agent Careful In His or Her Work?

You need an agent who will cover all the details that go into buying a home.

Can I save money by buying a home without a real estate agent?

You can shop for and buy a home without a real estate agent, but keep in mind that it will be more time-consuming. Homebuyers who already have a property in mind that they want to buy are the best candidates to forgo an agent, but if you're willing to do the extra legwork such as searching for properties, scheduling appointments to see them, coordinating inspections, and negotiating, then it's probably worth a try.

How can I negotiate the lowest price when buying a home?

Here are some negotiating tips:

Be willing to walk away from a deal. If you decide you must have a certain house, you have already lost negotiating power. There are other good properties out there.

Learn everything you can about the property before making your offer. For instance, how long has it been on the market? Has the buyer dropped the asking price? Why is the owner selling? The answers to these questions will help you to negotiate.

Know what comparable homes are selling for.

When the seller won't budge on price try to negotiate something else. For instance, try to get the seller to pay for repairs or improvements you would have done yourself.

Don't forget the real estate agent's commission. This is negotiable, too.

Should I have the home I want to buy inspected?

The purchase of a home is probably the largest single investment you will ever make. You should learn as much as you can about the condition of the property and the need for any major repairs before you buy.

The standard home inspector's report will include an evaluation of the condition of the home's heating system, central air conditioning system (temperature permitting), interior plumbing and electrical systems; the roof, attic, and visible insulation; walls, ceilings, floors, windows and doors; the foundation, basement, and visible structure.

The inspection fee for a typical one-family house varies by region and may also vary depending upon the size of the house, particular features of the house, its age, and whether additional services are required such as septic, well, or radon testing. The knowledge gained from an inspection is well worth the cost, however.

Not all states require home inspectors to be licensed or certified. When hiring a house inspector, qualifications, including experience, training, and professional affiliations, should be the most important considerations. One organization that can help you find a qualified home inspector is the American Society of Home Inspectors (ASHI). You can contact them through their website: www.ashi.org

What should I watch out for when dealing with home contractors?

Once you find a home you may want to do some remodeling or updating. Before you get started, however, make sure that the remodeling you're doing is something that the average home buyer wants such as a modern kitchen, larger closets, and modernized or additional bathrooms. Improvements in electrical wiring are also a plus, and when redecorating, keep future buyers in mind and use neutral colors.

Do not pay the contractor too much money upfront.

Before you sign a contract, work out a detailed plan that includes a target date for finishing various portions of the job, and a payment schedule as well. The contract should detail the costs of materials and labor so that you know what the contractor's profit will be. The final payment should be due on completion and should be the largest payment.

Don't contract with someone who's not bonded, licensed, and insured.

To find out whether a contractor is licensed, you can contact either a state licensing agency or check with a consumer protection agency to find out whether complaints have been filed against that contractor. Always ask to see copies of insurance policies.

Ask for as much detail as possible from the contractor about what the job will entail.

You never know what you'll find when you rip open that 30-year-old wall or start replacing that electrical wiring. On a big project, hire an independent engineer to inspect the work. If you don't, you could regret it later if the work has to be redone at your expense because it's not up to code.

How much should I expect to pay in closing costs?

Closing costs vary by state and by lender so it pays to shop around if possible. In addition, many of the fees associated with closing costs are negotiable such as credit checks, application fees, title searches, broker fees, appraisals, and other processing fees. Property taxes, homeowners' insurance (usually paid one year in advance), and private mortgage insurance (PMI) are not negotiable. One of the largest closing costs is likely to be the origination fee, which is typically 1 percent of the mortgage. You may also pay from 1 to 3 points or 1 percent to 3 percent in up-front interest. If you put less than 20 percent down, you will also need private mortgage insurance, which includes a one-time fee of up to 1 point plus a specific dollar amount that is included in your monthly mortgage payment.

Your lender must send you an estimate of your closing costs, referred to as a GFE or Good Faith Estimate (required by law), within three days of receiving your application and your realtor, lawyer, or escrow agent will give you the exact amount of your closing costs before closing. If you have only enough cash for a down payment, you can fold closing costs into your mortgage, but you will have to pay a higher interest rate. You can also ask the seller to pay some of the closing costs when you are negotiating your price.

Should I buy or rent?

Depending on your particular situation, owning a home makes might make more economic sense than renting one. With home prices dropping and mortgage rates at historically low rates, people who are planning to stay in their homes long-term can build equity over time and reap the benefits of writing off mortgage interest on their taxes. A modest increase in value represents an even greater gain for people who make a typical down payment of 20 percent or less. The higher your income tax bracket, the better your return.

You may want to rent however if you can find cheap housing, such as a rent-controlled apartment or the cost of renting is substantially less than owning. If you are young and single, newly divorced, move often with your job, or just don't want the responsibility of home ownership, then renting probably makes more sense. It's tough to recover the costs of buying a home within the first five to seven years, so if you're planning on moving before then renting is a better option. Retirees also may want to sell the family homestead and invest the proceeds. If you live in an area where housing prices are falling, then wait until the market bottoms out before you buy.

Mortgages

How can I minimize problems when getting a mortgage?

Much of the information required by your lender can be brought with you when you apply for a loan. To avoid delays, try to find out in advance exactly what documentation the lender will require from you. In general, however, most lenders will ask for the following documents: